Are Guidance Residential ‘Islamic Home Mortgage Loans’ Really Halal?

We hear this question often: Is Guidance Residential’s Islamic home financing really halal? The answer is a simple and resounding YES.

Guidance Residential’s model of home financing was created with the help of Islamic scholars to fill the need for Islamic home financing in America, and our Islamic mortgage alternative remains approved by independent scholars today.

The reason it’s halal is based in the fact that Islamic home financing isn’t a loan at all. There are some external similarities between Islamic home financing and a traditional mortgage loan, but in reality they are based on completely different foundations. Our Islamic finance offerings are riba-free and accepted by independent Islamic scholars as completely halal.

Are Mortgage Loans Permissible in Islam?

Before we go further, let’s address the question of whether mortgage loans are allowed in Islam.

Islamic scholars are in agreement that riba is prohibited in Islam. This means that observant Muslims will try not to place themselves in situations where they will have to either accept or pay interest. Therefore, a mortgage loan involving the payment of interest is not permissible in general.

Some scholars have stated that extenuating circumstances may make a mortgage loan permissible if it’s unavoidable. However, it is now possible to avoid using an interest-bearing mortgage loan when buying a home in the United States. With excellent halal mortgage options now available, it is clear that a Shariah-compliant approach is preferable, if not the only permissible option under Islamic law.

How Is Islamic Home Financing Different?

Guidance Residential’s Declining Balance Co-ownership Program functions on an entirely different premise than traditional mortgages. In a conventional mortgage, a bank lends money to the borrower, who pays it back with added interest. The Declining Balance Co-ownership Program doesn’t work this way, because charging interest is against Islamic law.

Instead of a lender-borrower arrangement, Guidance Residential and the customer become co-owners of a property. After Guidance helps the customer buy the property, the home buyer makes a monthly payment each month that includes two parts: One part goes toward buying more of Guidance’s share of the property, and the other part is a fee for using Guidance Residential’s share of the property. These are not loan repayments with interest, but rather, payments towards full ownership.

Even though it’s different from a regular loan, the Declining Balance Co-ownership Program aims to offer similar benefits to a conventional mortgage. It lets home buyers slowly purchase their homes with manageable monthly payments, similar to a conventional mortgage in that sense, but in a manner in line with Islamic law.

One key difference between shariah-approved financing and interest-based loans is that under Islamic finance principles, lenders can’t profit from someone’s hardship through practices such as excessive late payment fees. If home buyers are late on payments, they can’t be charged interest. The only fee for late payments is a small fee to cover the cost of collecting the money.

How Do Halal Mortgage Alternatives Work?

In the United States, there are three prominent models of Islamic home financing that can provide a halal alternative to a traditional mortgage loan:

- Musharakah, which is based on a co-ownership concept. The financier and the homebuyer enter into a joint investment to purchase a property. In its variant, Diminishing Musharakah, or the Declining Balance Method, the homebuyer progressively buys out the financier’s share in the property while paying a fee to use the part of the home still owned by the finance company. This method is the preferred form of Islamic home financing in the U.S.

- Ijara, which is essentially a rent-to-own contract. The financier acquires the property and leases it to the homebuyer. Part of each rental payment contributes towards the purchase of the property. The property is registered under the buyer’s name only after the rental term ends.

- Murabaha, where the financier purchases the property and sells it to the buyer on a deferred basis at an agreed profit. The buyer provides an initial deposit and pays the balance over time, including a profit margin in each installment. This arrangement doesn’t constitute a loan with interest, but a deferred payment sale.

Both the Ijara and Murabaha models have significant setbacks. In Ijara, the homebuyer essentially remains a renter until the full payment is made, missing out on the benefits of homeownership. On the other hand, Murabaha places a debt-like obligation on the homebuyer. Hence, many scholars of Islamic finance consider the best of the halal mortgage options to be Diminishing Musharakah, and this is the model that Guidance Residential has used since its establishment in 2002.

Guidance Residential’s Model

The Declining Balance Co-ownership Program by Guidance Residential is built on a variation of the diminishing musharakah model that enables its clients to buy a home in a manner that adheres to Shariah principles. The journey to homeownership begins when the customer initiates a co-ownership agreement with Guidance. This co-ownership between the customer and Guidance is established through a Limited Liability Company (LLC) specially formed for each home purchased.

Here’s how it works:

- The home buyer and Guidance Residential mutually agree to purchase the property.

- The property is purchased jointly, with each party owning a portion in proportion to their down payment investment.

- The home buyer makes monthly payments to Guidance Residential. These payments are split, part going towards the acquisition of a greater percentage of Guidance Residential’s stake in the property and the other part for full utilization rights of the entire property.

- Gradually, the home buyer acquires the entirety of Guidance Residential’s stake in the property, eventually becoming the sole owner.

Throughout this process, the property title carries your name, meaning you have full homeownership rights like any other homeowner in the United States, plus additional benefits.

3 Steps Guidance Residential Has Taken to Ensure Our Islamic Home Financing Is Halal

Step 1: Founded on Faith—and Meticulous Research

Guidance Residential’s purpose for existing is to provide an Islamic mortgage alternative for faith-conscious American families.

To that end, before ever opening for business, Guidance Residential spent three years researching and building a Shariah-compliant alternative to conventional mortgages that would work within the confines of American society.

Guidance worked with six world-renowned Muslim scholars to create a Declining Balance Model of Co-Ownership based on the Islamic principle of Musharakah Mutanaqisa or “Diminishing Partnership”.

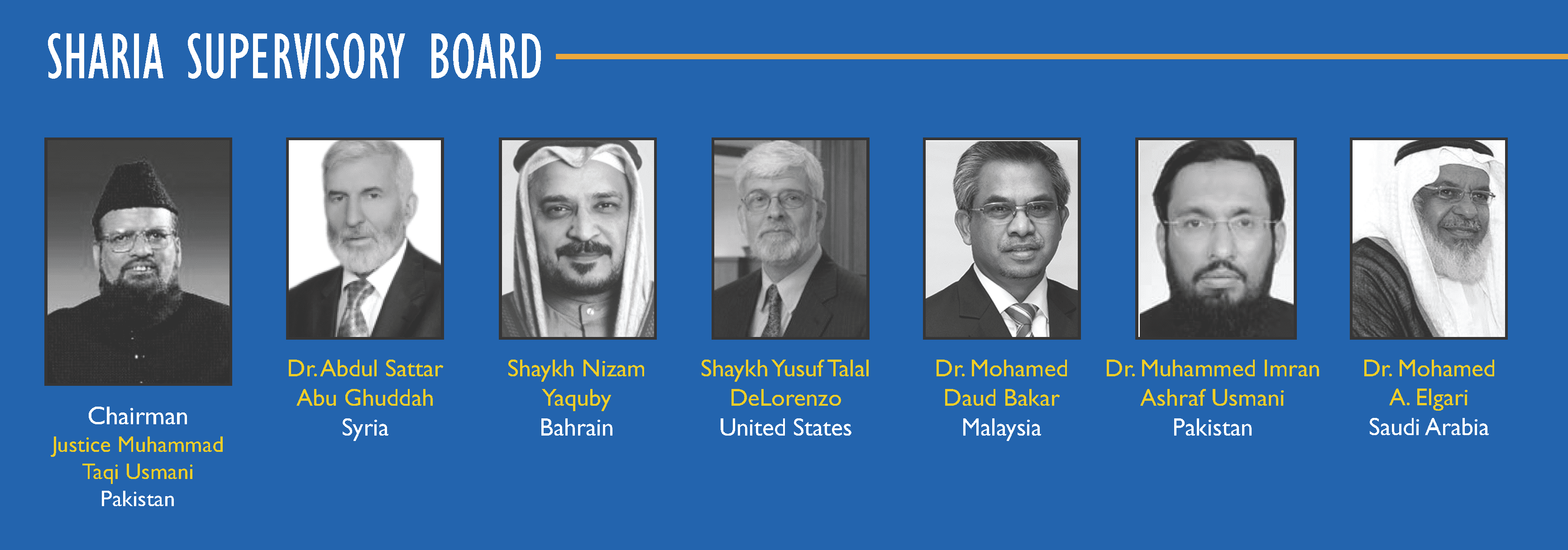

Unparalleled in its expertise, our independent Shariah Supervisory Board comprises some of the world’s leading scholars of Islamic financial transaction law. These renowned experts were actively engaged in the design of our home financing program, and they remain involved in its ongoing oversight.

This extensive development process ensured that the resulting model was carefully and firmly planted in authentic Islamic principles and in ethical, equitable, and permissible financial practices.

>> Fatwas on the permissibility of our services are available for view.

Any financing in the United States must also follow federal, state, and local rules and regulations. So our product is structured in a way that looks familiar to those who are familiar with a mortgage, and our pricing is competitive with conventional loans as well. However, comparing a loan with Islamic financing is like looking at similar icing on top of two very different cakes. Our cake is halal.

>> Related Read – The Difference Between an Islamic Mortgage and a Conventional Mortgage

Step 2: Focusing on Riba-Free Home Financing

Guidance Residential is not a bank. After taking the lead as the pioneering company offering Islamic home financing in America, that service still remains our sole focus.

It is now possible to find large banks that have begun to offer “Islamic home loans” on this side – while dealing with a multitude of other non-halal services and practices. Guidance Residential, on the other hand, has remained true to our authentic purpose and our principles.

Here is what we do each day: We buy homes together with individuals and families through a riba-free model of financing so our community members can have a home of their own. Our co-ownership model of home financing is a partnership in which we buy a home together with the customer.

Gradually, the homeowner buys out our share of the property, eventually owning the home in full. No riba (or interest) is involved, because it isn’t a loan.

>> Related Read – The Purpose of an LLC in Islamic Home Financing

As the sole partner who is actually using the home each day, the home buyer pays Guidance Residential a fee each month for using our portion of the property, while also buying out our share over time. This arrangement is completely acceptable under Shariah principles.

That’s all we do. It is now possible to find big financial institutions that have started to offer so-called Islamic mortgages on the side, while most of their financial practices are not halal. We are not a bank, and therefore we do not participate in any riba-based activities. All of our work is rooted in Islamic principles. Each year, our focus is solely on expanding our service area throughout the United States and making our customers’ home-buying journey even better.

>> Related Read – Non-Bank Mortgage Financiers & Servicers: What to Know

Step 3: Audits By an Independent Board of Scholars

Guidance Residential takes an additional step to ensure transparency and scrupulous compliance: we undergo annual audits by our independent Shariah Supervisory Board.

Our independent Shariah Board comprises seven scholars, headed by Justice Muhammad Taqi Usmani, who is also the chairman of the Shariah Board for the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI).

The board appoints an auditor with specialized knowledge in shariah as well as finance to examine Guidance Residential and report back on the extent of our compliance with Islamic finance principles. The audit ensures that a company is compliant with best practices and can detect early signs of possible noncompliance.

>> Related Read – What Is An Islamic Mortgage? How Does It Work?

The audit verifies the following:

- That a Shariah-compliant structure is in place

- That Shariah policies are updated and implemented

- Whether employees’ appraisals show that they have complied with guidelines

- That all products offered to consumers have been approved by the Shariah Supervisory Board and that a fatwa has been obtained

It also verifies that any income from non-compliant sources have been allocated to charity, and it reviews transactions for errors and opportunities for improvement.

This audit, conducted according to international AAOIFI standards, provides transparency for government regulators, investors, and consumers.

The Result

This strong and secure foundation and meticulous adherence to Shariah principles from Day 1 is what sets Guidance Residential’s program apart from others. A pioneer in Islamic home finance, Guidance Residential ensures that our customers can trust that the biggest purchase of their lives is conducted in accordance with their faith. And we renew that commitment with every passing year.

Get Started Now

Looking to refinance or purchase? Have a friend or family member who is looking for a home? >> Call 1.866.Guidance, find an account executive in your state or start an application online today!

>> Related Read – Do You Have to Be Muslim to Get a Riba (Interest) Free Mortgage?

Originally published November 2020, updated November 2023.