Ideas for a riba-free lifestyle

How can Muslims living in the West lead a life that does not involve riba? Is it really possible in a society that is centered on interest based financing systems? These are questions that every Muslim comes across at some point in time.

Islamic finance principles teach that usury or interest on financial transactions causes an imbalance in the economic structure of the society.

In this article, we discuss a few ideas that can help you keep your life free from riba.

What Is Riba?

Riba, an Arabic term often translated as “interest” or “usury,” holds significant importance in Islamic finance and ethical financial practices.

The word riba means excess, increase or addition. It refers to any excess compensation, typically the additional money paid by a borrower to a lender over and above the principal of a loan.

What Does Islam Say About Riba?

The holy Quran prohibits riba in several places, including in Surah Al-Baqarah:

“… Allah has permitted trading and forbidden interest…”

(Quran, 2:275)

The Prophet Muhammad spoke of the prohibition of riba as well. In his last sermon, he said:

“God has forbidden you to take Riba (usuary), therefore all Riba obligations shall henceforth be waived. Your capital, however, is yours to keep. You will neither inflict nor suffer inequity.”

Islamic scholars agree that riba is to be avoided if at all possible.

Why Is Riba Prohibited in Islam?

Riba is prohibited in Islam due to numerous ethical considerations involving societies and individuals. Riba is considered to be exploitative and unjust, violating the principles of fairness and mutual benefit. A loan in Islam is meant to be an act of kindness and generosity, not a way to profit through interest or riba. Riba is viewed as harmful to individuals and society for reasons including the following:

Exploitation of Need: Charging interest takes advantage of the borrower’s financial difficulties, placing an undue burden on them.

Imbalance of Wealth: Riba allows wealth to accumulate with the financier while potentially worsening the financial struggles of the borrower. Those with wealth increase their wealth without taking on the risk of trade or investment or contributing to productive activities. Islam instead promotes fair and sustainable growth.

Violation of Justice: Islam emphasizes justice and equity in financial dealings. Profiting from a loan contradicts these principles by creating an unequal and unjust relationship. It creates an imbalance of power between parties, benefiting the financier at the expense of the borrower.

Instead, Islamic finance encourages profit-sharing models, ethical investments, and trade-based transactions that promote shared risk and reward among all parties involved.

Challenges of Avoiding Interest

For Muslims living in America, avoiding riba, or interest, can be a significant challenge. Modern financial systems are deeply intertwined with interest-based transactions, making it difficult to navigate everyday financial activities without dealing with interest. From purchasing a home to using credit cards, interest is often embedded in the financial products and services available in the financial landscape of the West.

Why Is It So Difficult to Avoid Riba?

Interest-Centric Financial Systems:

The U.S. financial system is built on interest-based models. Financial institutions like banks and credit institutions, and even government programs rely on interest to generate profits and sustain operations. This widespread reliance on interest makes it challenging to find alternatives that align with Islamic principles.Limited Availability of Islamic Financial Options:

While Islamic finance has grown globally, its presence in America is still relatively limited. There are fewer institutions offering Shariah-compliant products, and those that do exist may not be accessible to everyone due to geographic or financial constraints.Everyday Financial Tools:

Common financial tools like credit cards, savings accounts, auto financing, student loans, and traditional mortgage loans often involve interest in some form.Economic Pressures:

High costs of living, housing, and education can pressure individuals into feeling the need to rely on conventional financing options that involve interest.

Practical Steps to Minimize Riba

Despite these challenges, there are ways to reduce reliance on interest and align financial practices with Islamic values.

1. Adopt a Debt-Free Lifestyle

One of the cornerstones of financial transactions in the current era, credit cards are the easiest and unsuspecting of ways through which riba can enter your life. Though they can make your day-to-day purchases convenient, a missed due date could lead you into paying interest on the money you owe.

To avoid this, establish a disciplined approach to managing your credit card payments:

Set Alerts: Use a reminder app on your smartphone or computer to keep track of your due dates. Key in your billing cycles in such a way that you’re alerted a couple of days before the grace period begins.

Pay in Full: Always strive to pay your credit card bill in full within the grace period to avoid incurring any interest.

Limit Usage: Use credit cards sparingly and only for essential purchases, ensuring you can cover the costs immediately.

2. Make Conscious Spending Choices

A riba-free lifestyle requires mindfulness and common sense in making informed decisions:

Avoid Installment Plans with Interest: When purchasing items, opt for interest-free installment plans or save up to buy outright.

Support Ethical Businesses: Choose to buy from businesses that align with your values and avoid those that engage in exploitative practices.

Track Your Expenses: Maintain a budget to monitor your spending habits and ensure they align with your financial and spiritual goals.

3. Follow Halal Banking Practices

Banks are at the nucleus of the interest-based economic system. However, it is hard to even imagine a society that is devoid of banks. To ensure that their savings don’t earn interest, some devout Muslims opt for non-remunerative checking accounts instead of conventional savings accounts.

Here are some practical steps to follow halal banking practices:

Choose Islamic Banking and Investments: Look for banks or financial institutions that operate under Islamic principles, offering accounts that are fully compliant with principles of sharia law. Halal investment opportunities — often involving carefully selected choices on the stock market –and fully Islamic finance products are also available now as well.

Avoid Interest Money: Many Muslims choose to save money in a checking account rather than a savings account to avoid receiving interest. Others ensure that any interest accrued is not used for personal benefit, instead giving it away for charity.

Stay Informed: Educate yourself about Islamic banking practices and seek financial advice from knowledgeable scholars or professionals in the field for future decisions.

4. Practice Halal Home Buying Methods

Owning a house is an important part of the American dream. But as conventional mortgages are ruled out since they involve paying interest, you can finance your home through halal sources. These include money saved over a period of time, borrowings from friends and family, or the most viable option, which is taking an Islamic mortgage from a Sharia compliant home finance company.

Here are some tips for halal home buying:

Save Strategically: Build a disciplined savings plan to accumulate the funds needed for a significant down payment.

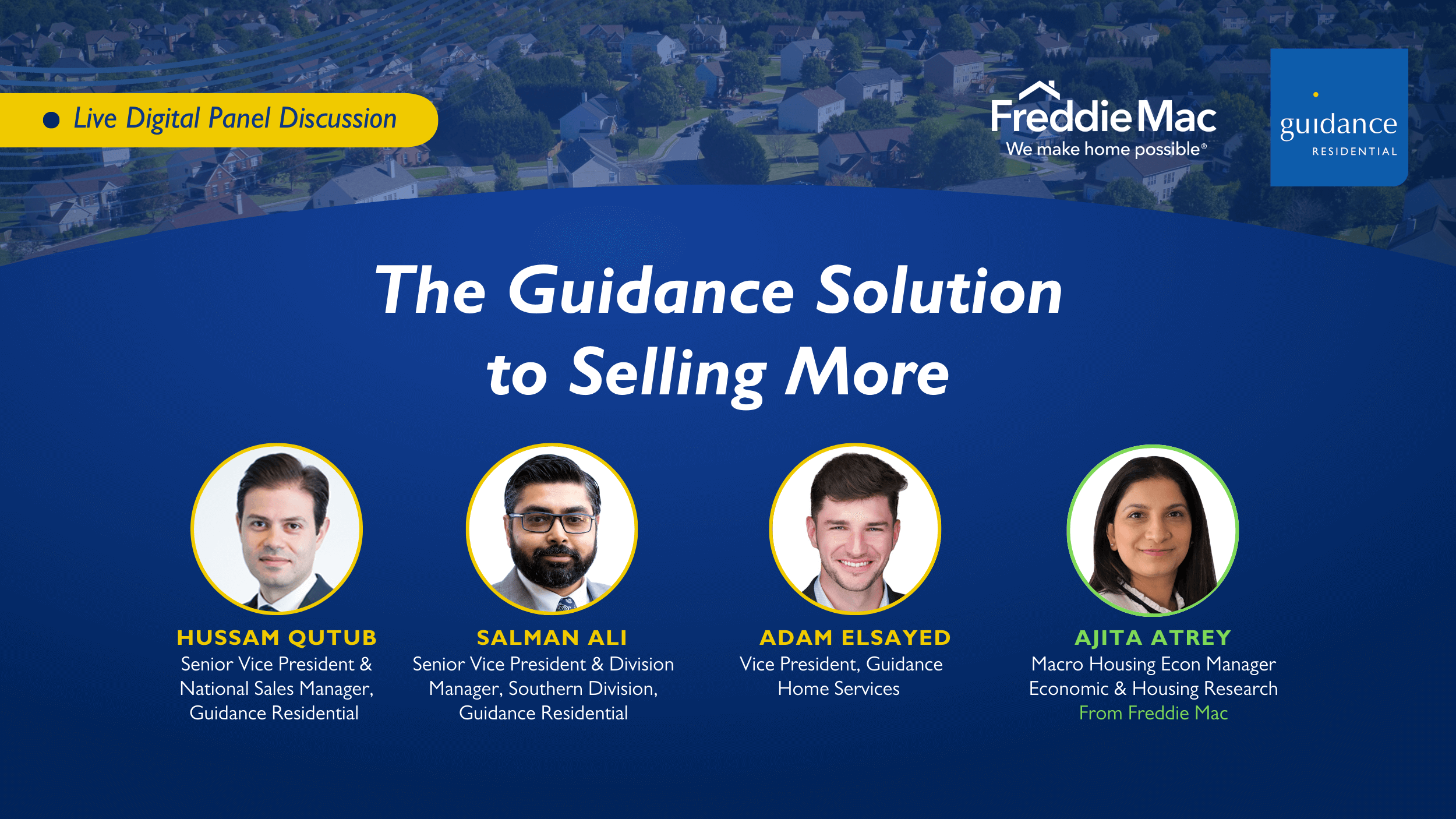

Explore Islamic Financing: Seek out Sharia-compliant home financing options like those offered by Guidance Residential, which use co-ownership agreements instead of interest-based loans.

Plan Within Your Means: Avoid overstretching your budget and choose a home that fits your financial capacity to ensure a stress-free ownership experience.

Choose a Financier Carefully: Some providers of so-called Islamic mortgages are affiliated with banks. Watch out — by financing your home through a bank-affiliated provider, you are using funds obtained through riba, and supporting the bank in its continued use of this prohibited practice. Instead, choose an authentic provider of Islamic home financing, unaffiliated with a bank. Don’t be fooled by a name that sounds Islamic — ensure that your provider is truly independent of any bank.

How Does a Halal Home Purchase Work?

For Muslims seeking to purchase a home in a Shariah-compliant way, Guidance Residential offers a halal alternative to conventional interest-based financing. Our unique model is based on the principles of Declining Balance Co-Ownership and avoids interest, ensuring that the home purchase aligns with Islamic values.

Here’s how a halal home purchase works with Guidance Residential:

Co-Ownership Model

Guidance Residential uses a partnership-based approach known as Declining Balance Co-Ownership (Diminishing Musharaka). Instead of a traditional loan, we form a co-ownership agreement with the homebuyer. Together, you and Guidance Residential jointly purchase the property.

Your Share: Your down payment represents your initial share of ownership in the home.

Guidance Residential’s Share: The remaining cost of the home is covered by Guidance Residential, representing the financier’s share of ownership.

Gradual Ownership Transfer

Over time, you gradually purchase Guidance Residential’s share of the property through monthly payments. Each payment includes two components:

Acquisition Payment: This increases your ownership share in the home.

Usage Payment: This is a fee you pay for the exclusive use of the share of the home owned by Guidance Residential.

As you make these payments, your ownership in the home increases, and Guidance Residential’s share decreases. Eventually, you will fully own the property. Note that you maintain full ownership rights from the beginning, the same as with a traditional mortgage.

No Interest or Riba

Unlike conventional financing, this model avoids interest entirely. Instead, it is structured as a partnership, where the payments are tied to your gradual acquisition of the property. This ensures compliance with Islamic principles while providing a practical solution for homeownership.

Transparent and Ethical Practices

Guidance Residential operates with transparency and fairness, which are central to Islamic finance. All terms and conditions are clearly outlined, ensuring that homebuyers understand their obligations and rights throughout the process.

Benefits of Choosing Guidance Residential

Shariah Compliance: Guidance Residential’s financing model has been reviewed and approved by Islamic scholars to ensure it adheres to Shariah principles.

Flexibility: The declining balance model allows for flexible payment structures, giving you the ability to accelerate your ownership if you wish.

Peace of Mind: By avoiding riba, you can fulfill your dream of homeownership while staying true to your faith.

Making Homeownership Halal and Accessible

Guidance Residential bridges the gap between modern financial needs and Islamic values, providing Muslims in America with a halal way to purchase a home. Our innovative approach not only eliminates interest but also fosters a sense of partnership and fairness, making the process of homeownership both ethical and practical.

For those looking to buy a home without compromising their religious principles, Guidance Residential is a trusted option that aligns with the values of Islamic finance.

Enjoy the blessings of a riba-free life

A riba-free life can be quite a blessing. As you avoid involving interest in your transactions, you enjoy relief from the tension and stress of struggling to pay bills that only keep increasing — plus the peace of mind of knowing your finances are aligned with your faith and values.

Ready to Get Started?

Buying a home is one of the most important decisions you will make. The team at Guidance Residential is here for you, from the first step of pre-qualification or pre-approval, on through to finding the right real estate professional for you and your family — or refinancing a home you already own. We invite you to explore the home buying process with Guidance Residential today. You can also instantly calculate an estimate specific to your personal situation with our finance calculators online.

Guidance Residential remains the #1 U.S. Islamic home financing provider, with more than 40,000 families assisted over more than 20 years. Learn more about our co-ownership model of Islamic home financing, and get started on your home finance journey today.

Your Guidance Residential Account Executive is here to help with any questions. Looking to refinance or purchase? Have a friend or family member who is looking for a home? Call 1.866.Guidance, or start an application today.

Originally published February 2015, updated December 2024.