What Is an Islamic Mortgage and How Does It Work?

“What is an Islamic mortgage?” — it’s a common question. The short answer is that what some call an Islamic mortgage isn’t actually a mortgage loan at all.

Islamic home financing may look similar to a mortgage in some ways, but it is based on an entirely different foundation.

Islamic home financing is free of riba (loosely translated as interest), and it is a (or permissible) way for faith-conscious Muslims and non-Muslims to buy a home.

>> Related Read: Do You Have to Be Muslim to Get an Interest-Free Mortgage?

How Islamic Home Financing Works

Islamic Home Financing vs. a Conventional Mortgage

At the heart of a traditional mortgage loan is the practice of lending and borrowing money at interest. The home buyer borrows money to buy a home, agreeing to pay it back over a period of time, with added interest.

This is not an acceptable business practice under Islamic principles.

Lending is a charity

One reason is that under Islamic law, a loan is meant to be a charitable arrangement — a way for one person to help another who is experiencing hardship. It’s a noble act, and it requires that the borrower only pay back what they borrowed and the lender only to expect the exact amount that was lent.

Paying interest turns it into a business transaction. A loan is not a way to earn money.

Asset-backed financing

It is also not acceptable under the rules governing Islamic financial transactions to buy or sell something that has no intrinsic value.

In a traditional mortgage, the interest paid by the home buyer is not actually paid for the home itself. Instead, it is money that is paid to the lender to use their money. It’s like agreeing to buy $20 for $30.

But money has no intrinsic value — it is merely a medium of exchange, so a mortgage loan takes something that has no intrinsic value and makes more money from it.

Sales contracts must be backed by assets in Islamic finance.

Equity

A traditional mortgage enables home buyers to make what could be the biggest purchase of their lifetime, but at the same time it profits from their needs and creates an uneven and unequal relationship. The lender holds all of the power in this relationship.

Few people know that mortgage alternatives are available.

>> Related Read: Islamic Home Buying Questions and Answers

An Equitable Alternative

The Islamic approach to finance and trade allows businesses to make a profit and allows people to gain assistance with large purchases. However, it places limits on business practices to protect vulnerable people from exploitation and to help build healthy communities.

So rather than a lender/borrower relationship, halal mortgages instead structured as an investment in which both parties share profit and loss.

Islamic financing is an ethical and equitable solution to financing needs. It is not limited to followers of any one faith; in fact, it appeals to all people who are interested in a more transparent and ethical system of finance as well.

Islamic home financing is an ideal solution for Muslim and non-Muslim families looking to buy a home in accordance with their values.

Islamic Mortgages Are Riba Free and Equitable

All authenticated forms of Islamic home financing and sharia compliant mortgages are free of riba, the practice of buying with an interest-bearing loan. The Islamic financial institutions earn a profit in other ways, and the relationship is fundamentally different from a lender/borrower relationship.

3 Types of Riba-Free Mortgages

Three types of shariah compliant home financing models are fairly well-known in the United States:

1. Musharakah is a form of co-ownership between the home buyer and the financing company. The two parties agree to invest in a property and buy the home together. In a version called Diminishing Musharakah, or the Declining Balance Method, the home buyer gradually buys out the financier’s stake in the property, while paying a fee to use the part of the property still owned by the financier. (The home buyer is the legal owner from the beginning, however, with full ownership rights.) This is the most common and authenticated form of Islamic home financing in America.

2. Ijara is basically a lease-to-own arrangement. The financier purchases the property and the home buyer rents it. A portion of each payment goes toward the tenant’s future ownership of the property. The home is not registered in the buyer’s name until repayment is complete.

Murabaha is a model in which the financier buys the home and sells it to the customer on a deferred basis at an agreed-upon profit. The customer pays a deposit and repays the financier over the mortgage term, including a profit charge with each payment. This is not a loan with interest — it is a resale with a deferred fee.

The last two models have significant drawbacks. In Ijara, the home buyer is basically a tenant for the entire period of the contract and does not enjoy the benefits of homeownership until repayment is complete. Meanwhile, Murabaha creates an obligation for the home buyer that resembles debt. So

Diminishing Musharakah has been deemed by the most highly respected scholars in Islamic finance as the best option, and it is the approach taken by Guidance Residential since inception in 2002.

>> Related Read: 10 Common Questions About Buying a House the Halal Way

How Islamic Home Financing Works with Guidance Residential

About the Co-Ownership Model

Guidance Residential’s proprietary model of Islamic home financing is a form of Diminishing Musharaka called Declining Balance Co-Ownership.

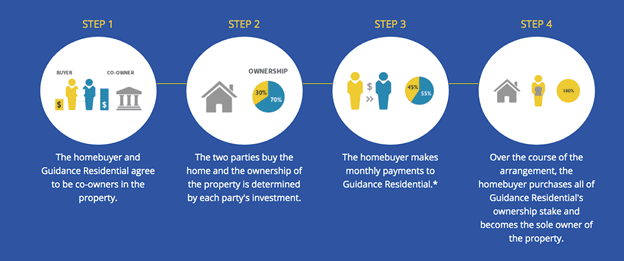

In this model, once the home buyer and Guidance Residential agree to be co-owners of a particular property, the two parties buy the home together. The percent of the property owned by each party is determined by each side’s investment. (For example, if the home buyer pays 20% of the purchase price, they own 20% of the home, and Guidance owns 80%.)

The home buyer then makes monthly payments to Guidance Residential, increasing the share they own until they have purchased all of Guidance Residential’s ownership stake. Then the home buyer becomes the sole owner of the property.

In this halal mortgage model, the home buyer benefits from owning and living in the home long before they have finished buying Guidance Residential’s share in the property, so they pay Guidance a fee for using Guidance’s share of the property

One benefit of this co-ownership model is risk sharing — that the Islamic mortgage provider shares the risks of home ownership with you. And fees are capped, free of the hidden expenses of a traditional mortgage.

>> Related Read: The Guidance Difference

An Overview of the Islamic Home Buying Process

Buying a home with a Muslim mortgage involves the same four steps that any regular mortgage in the U.S. requires: application, processing, underwriting and closing. The difference is that the contract itself is halal, or sharia compliant.

Step 1. Qualification or Application

The first step is to provide Guidance Residential with basic information about you and your finances so that you can find out how much funding you may qualify for.

You can start with a quick Pre-Qualification early in your journey if you would like to obtain a rough estimate of the home price you may be able to afford. But you can also skip that optional step and move directly to your Pre-Approval Application

When you fill out your Pre-Approval application, you will submit documentation of information such as income, employment and savings. A financier will verify your application and let you know what financing you may qualify for.

Being Pre-Approved means that you are ready to seriously begin looking for a home — Realtors will expect you to be Pre-Approved before they show you homes. Pre-Approval is also the first step if you would like to refinance a home you already own. Our online application walks you through the process and makes it simple to complete at your convenience.

After you make an offer on a home and your contract has been accepted by the seller, you will need to complete your application for financing that particular property. If you have already been Pre-Approved, much of the work will have already been done.

Guidance Residential offers a streamlined online application process that will speed up your Pre-Approval, and then allow you to merely add the final documentation once your contract is accepted on the home you are purchasing. You can complete the entire application process online from home. You can even upload documents on your phone and check the status of your application through your online portal.

A Guidance team member is always there to help as well.

Recap—what to do in this phase:

• Complete Pre-Approval application

• Provide documentation for Pre-Approval

Step 2. Processing

Once you have found a home and are under contract, your Account Executive will send you a package including an estimate with information such as the contract amount, costs, fees, terms, and expected monthly payment.

Once you accept, you will need to submit documentation on employment, finances, and assets. Guidance will also obtain documentation from third parties, such as title, private mortgage insurance, flood report, and the appraisal of the property’s value.

Recap—what to do in this phase:

• Provide additional financial documentation

• Arrange for home inspection and appraisal

>> Related Read: What to Expect During the Home Financing Process

Step 3. Underwriting

Now your work is mostly done, and a licensed underwriter at Guidance Residential will thoroughly evaluate your financial information and supporting documentation. He or she will confirm your eligibility for financing while also ensuring that the application complies with federal regulations.

As the underwriter examines your documentation, they may need to make additional requests. It is important to respond to the requests thoroughly and in a timely fashion so your closing is not jeopardized.

Recap—what to do in this phase:

• Be prepared to provide additional documentation

• Pay close attention to deadlines and details

>> Related Read: What Does an Underwriter Do?

Step 4. Closing

This is when your home purchase is finalized and ownership of your new home will be transferred to you. On your closing date, you will meet with a team including your Realtor, the seller’s Realtor, and possibly a representative of the title company. After all the papers are signed, the keys are handed over and the home is yours!

In the weeks leading to closing, it’s important that you keep everything the same with your finances and remain in your current residence and job so you don’t jeopardize your closing. Don’t make any large purchases, because that will affect your credit and could delay your closing.

Recap—what to do in this phase:

• Keep everything the same with your job and finances

• Appear at closing

• Receive the keys

>> Related Read: What Fees Do Closing Costs Include?

Ready to Buy or Refinance?

Buying a home is one of the most important decisions you will make. The team at Guidance Residential is here for you, from the first step of pre-qualification or pre-approval, on through to finding the right real estate professional for you and your family — or refinancing a home you already own. We invite you to explore the home buying process with Guidance Residential today. You can also instantly calculate an estimate specific to your personal situation with our finance calculators online.

Guidance Residential remains the #1 U.S. Islamic home financing provider, with more than 40,000 families assisted over more than 20 years. Learn more about our co-ownership model of Islamic home financing, and get started on your home finance journey today.

Your Guidance Residential Account Executive is here to help with any questions. Looking to refinance or purchase? Have a friend or family member who is looking for a home? Call 1.866.Guidance, or start an application today.

Originally published in October 2020, updated April 2025.