Buying a House in Texas

Texas can be a fantastic place to buy a home, whether you’re looking for the energy and activity of Dallas or want to buy plenty of acreage in a rural, quieter part of the state. Buying a house is a major milestone that’s surrounded with excitement, but if you’re buying your first house, the process can seem overwhelming.

The recent market fluctuations, including high sale prices, can make buying a home even more stressful. That’s why we’ve created this guide to help you prepare for what’s ahead and to ensure that you’re ready for every step of the process. These tips can help you to buy a house in Texas with confidence, no matter what the market brings.

>> Related Read – Housing Market Predictions for 2023 + The Next 5 Years

How to Buy a House in Texas in 9 Steps

These nine steps can help you to understand what to expect when you buy a home. Knowing what to expect during the homebuying process will help you get ready and reduce your stress too!

Step 1. Evaluate Your Finances

When it comes to the things to do before getting pre-approved for a mortgage, start with your finances. Before you start shopping around for homes, it’s important to take a close look at your finances. Understanding the specifics of your finances will help you to determine if you’re really ready to buy a home, and it will help you to decide how much house you can afford so you can narrow down your search.

Start by evaluating how much money you have for a down payment. Depending on your mortgage, you may need a down payment from 3% to 30% of the cost of your home. Putting down a larger down payment will help to lower your monthly payments, so it’s never too early to start saving up.

This is also a good time to create a monthly budget if you haven’t done so already. Your budget will give you a better idea of how you’re spending your money each month, as well as how much money you have left over to work with and save.

Take some time to prepare financial documents that a home financier might need during the pre-approval process. Most lenders will want to review your taxes, documents proving your employment history, bank statements from the past three months, and documents proving your rental history.

What Credit Score Is Needed to Buy a House in Texas?

To buy a house in Texas, you will usually need a credit score of at least 620. Keep in mind that even a score of 620 doesn’t guarantee that you will be approved for a mortgage. A credit score of 760 or more will increase your chances of approval.

In addition to affecting your chances of getting approved for a mortgage, your credit score also affects your interest rate. A strong credit score can help you to get a lower interest rate, but a poor credit score can mean that you will pay higher interest on your loan. Improving your credit takes time, so it’s a good idea to check your credit rating early on. If you have low credit and want to buy a home soon, consider asking a family member to act as a co-signer.

How Much Cash Do You Need to Buy a House in Texas?

The average cost of a home in Texas is $289,252. To buy a home at that price, you will need $57,850 for a 20% down payment.

The exact amount that you need to put down will vary depending on the type of loan that you acquire. For example, an FHA loan can allow you to put down just 3.5% of your home’s value, and some conventional loans also allow you to put just 3% down. You will also need to factor in other expenses, like closing costs.

Keep in mind that it’s always better to put more money down if you can afford to. A larger down payment will help to reduce the size of your mortgage payments, allow you to pay less in interest over the life of the loan, and potentially help you to pay off your mortgage sooner.

>> Related Read – Is It Better to Put a Large Down Payment on a House?

Step 2. Explore Your Home Financing Options

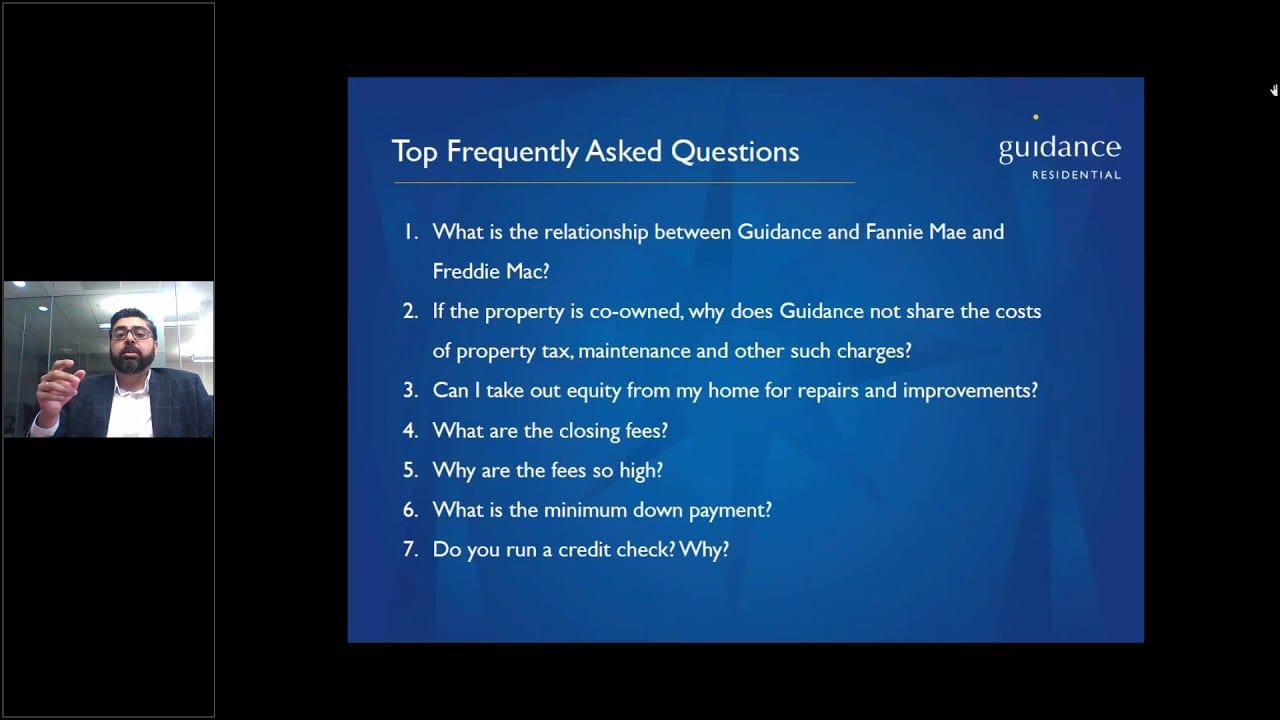

You’ll have several options when it comes to financing your home. An Islamic mortgage can be an excellent alternative to a conventional mortgage. With an Islamic mortgage, you can avoid some of the hidden risks in conventional and FHA home loans.

One of the greatest differences between an Islamic mortgage and a conventional mortgage is the fact that an Islamic mortgage is an interest-free home financing arrangement. Islamic law prohibits riba, or interest. An Islamic mortgage with a non-bank mortgage financier like Guidance Residential is a co-ownership mortgage.

Since you and Guidance Residential co-own the home, you will both own shares. You will have exclusive rights to use the entire property, and with your monthly payments, you will gradually buy out Guidance Residential’s shares. Eventually, you will own the home outright.

There are multiple advantages to this arrangement. With an Islamic mortgage, your late payment fees are limited. They are small, fixed amounts designed to only cover the administrative costs of reaching out to you and following up on those payments.

>> Related Read – Do You Have to Be Muslim to Get a Riba (Interest) Free Mortgage?

Step 3. Get Pre-Approved for a Mortgage

It’s best to get pre-approved or pre-qualified before you start shopping for a home. If you get pre-qualified, then a lender will review some basic information that you self-report. You’ll receive an estimate of how much you can afford to spend on your home.

Getting pre-approved is the next step, and a lender will analyze your financial information in depth and perform a credit check. The lender will give you a mortgage amount that you will likely be approved for, and the pre-approval will be valid for a certain amount of time.

There are many reasons to get pre-approved for a mortgage. Your pre-approval letter can demonstrate that you are a serious buyer. You may be required to be pre-approved before being able to view a home, and your pre-approval can increase the chance that a seller accepts your offer on a home.

With the information on your pre-approval, you can better understand mortgage rates and estimate what you’re likely to pay each month for your mortgage. You can use this information to determine how much you’re comfortable paying for your home, and that’s important information that will help you with your search.

>> Related Read – How Long Does a Pre-Approval Take? A Case Study

Step 4. Find a Real Estate Agent in Texas

Your real estate agent acts as a partner who will help you through the whole process of buying a home. Your agent will help you to view and evaluate houses, make an offer on a home, negotiate a home’s price, and ultimately close on your home.

Finding a real estate agent who is local to the area where you want to move is helpful. Agents who know the local market can help you to determine the best neighborhood to live in and will have an understanding of fair asking prices in the area. Real estate agents with established local connections may be aware of properties that are coming up for sale, and they may be able to help you find a home that you would have otherwise missed.

>> Related Read – Recruiting a Real Estate Agent? 5 Questions to Ask

Step 5. Select the Right Location

It’s important to weigh multiple factors when deciding which Texas location is right for you. Real estate taxes will vary depending on the school district, city, and county where you live. Texas doesn’t have individual state income tax, so property taxes can be hefty.

You’ll also want to consider the weather in Texas. While the state has an overall warmer climate, it’s still subjected to plenty of natural disasters, including the winter freeze of 2021. You will need to carry homeowner’s insurance to protect the home in case of damage, and homeowner’s insurance costs more in Texas than in most other states.

Finally, consider the type of area that you want to live in. For example, Dallas county is a highly populous county with a thriving arts district. Harris county is near the Gulf of Mexico, and it has beautiful beaches that you won’t find elsewhere in the state. Think about the type of environment where you want to live, and search for a location that offers those features.

What Are the Best Places to Live in Texas?

Texas is full of highly appealing locations, and it also delivers plenty of variety:

- Austin is a college town and the state capital, and it features a rapidly growing metro area with a diverse culture and plenty of outdoor activities.

- Houston is a massive city that’s full of employment and entertainment opportunities, but it’s also a highly affordable city to live in.

- Fort Worth is preferred for its affordability and safety, and it offers a rich culture and lots of entertainment options.

- San Antonio boasts a rich Hispanic culture, as well as theme parks and a thriving arts district.

>> Related Read – How Do I Know If A Neighborhood Is Safe? 4 Ways to Check

Step 6. Begin House Hunting in Texas

There are certain times of the year when it’s best to buy a home in Texas. Home prices tend to be lowest in January, but housing inventory reaches its peak in April. Home prices spike in October, so it may be best to start searching for a house in the winter.

>> Related Read – How to Find Houses Before They Hit the Market

Step 7. Make an Offer (and Get It Accepted)

Once you’ve found a home that you love, your next step will be to make an offer. Your real estate agent will help you through this process, which starts with reviewing the prices that similar local homes recently sold for and deciding how much to offer. This is also the time to determine any contingencies you want to place on the sale, like making it dependent on the findings of a home inspection.

Your agent will help you to prepare an offer letter and will deliver it to the seller’s real estate agent. The seller can accept or reject your offer, or they might decide to make a counteroffer. You can negotiate until you hopefully find a price that works for you both. At that time, you will sign a purchase and sales agreement that outlines the terms of the purchase, including the price you’ve agreed on.

>> Related Read – Can You Make an Offer Without a Pre-Approval Letter?

Step 8. Obtain a Home Inspection and Appraisal

It’s always a good idea to schedule a home inspection. During the inspection, an inspector will review the home’s interior and exterior and look for potential issues. You can ask the sellers to correct any issues that are found, or you can use those issues as a bargaining point to try to negotiate the home’s price down.

You will also need to schedule an appraisal. During this appointment, an appraiser will consider factors like the home’s condition, age, and the value of similar local homes that recently sold. The appraiser will estimate the home’s value and will report that information back to your lender.

>> Related Read – What Not to Do Before & When Buying a House

Step 9. Close on Your Texas Home

The last step of buying a home is to close on the purchase. You will need to have your down payment and closing costs ready. In Texas, closing costs are around 2 to 6% of the home’s price. Closing costs include fees like recording fees and transfer taxes. Additionally, you will need to pay your attorney fees, homeowner’s insurance, and any other fees, like homeowners association fees.

>> Related Read – Ultimate Moving Guide + Moving Across-Country Checklist

The Bottom Line: Buying a House in Texas Is Easier with Our Help

If you’re ready to start your journey to buying a home in Texas, Guidance Residential can help. We offer financing solutions and, thanks to our sister company, Guidance Home Services, we can help you to find a local real estate agent.

Get pre-qualified online in fewer than 10 minutes, and we’ll connect you with a knowledgeable and reliable real estate agent in Texas to ensure your home-buying experience goes smoothly.