How an Islamic Mortgage Can Help to Reduce the Risk in Buying a Home

Are you a Muslim home buyer looking for a responsible and ethical way to finance your dream home? If so, you may want to consider an Islamic mortgage.

In this guide, we’ll explain what an Islamic mortgage is. We’ll also look at how it works and the benefits it offers for homebuyers.

What is an Islamic Mortgage?

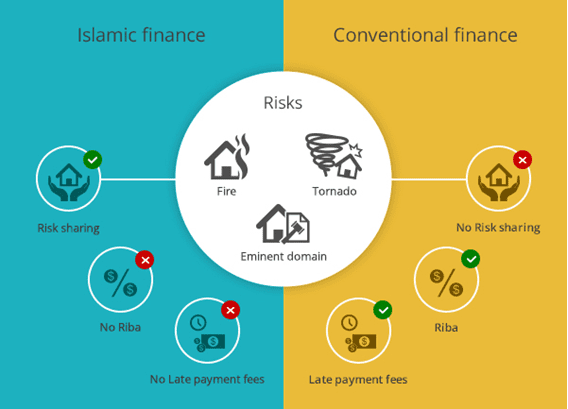

Islamic mortgages are structured on an entirely different foundation from conventional mortgages. They are based on the principles of Islamic finance, which prohibits interest-based transactions and promotes ethical and responsible transactions.

Islamic home financing is designed to help Muslims buy homes without violating the principles of their faith. Increasingly, it also appeals to home buyers of other faiths as well due to its more equitable nature.

An Islamic mortgage is different from a traditional mortgage because they do not involve lending money.

Islamic mortgages can come in one of several halal – or permissible – forms. In the form most common in the United States, the financier and home buyer purchase the home together as co-owners. The home owner then makes monthly payments, gradually buying out the financier’s share of the property.

Related Reads –

Principles of Islamic Finance

The principles that underpin Islamic home finance include the following:

- Prohibition of interest (riba): Islamic finance prohibits the payment and receipt of interest. Instead, it encourages the sharing of profits and losses between the financier (co-owner) and the home buyer.

- Risk-sharing (mudarabah): Islamic finance encourages the sharing of risks and profits between business partners. This promotes responsible investment and helps to ensure that both parties are invested in the success of the venture.

- Asset-based financing (murabaha): Islamic finance requires transactions to be backed by assets. A traditional mortgage does not actually involve the transfer of an asset between the home buyer and the lender; instead, it is essentially a practice of purchasing money for the promise of more money later.

- Asset-backed financing promotes responsible and ethical transactions by ensuring that the financier has a stake in the success of the investment.

How Does an Islamic Mortgage Work?

Although an Islamic mortgage is structured on an entirely different foundation from a traditional one, the process of obtaining one will look similar.

It begins with the following steps:

- The home buyer applies for financing.

- The financier conducts a credit check and evaluates the home buyer’s ability to pay their obligations.

If the home buyer is approved, the financier provides a portion of the funds needed to purchase the property. The home buyer then makes monthly payments to the financier until they own the entire home outright.

Related Watch – How Does an Islamic Mortgage Work?

Benefits of Choosing an Islamic Mortgage

There are several benefits to choosing Islamic home financing over a conventional mortgage.

Ethical and Responsible Transactions

Islamic financing promotes responsible and ethical financial transactions in part by emphasizing the sharing of risk between the two parties. This measure ensures that both parties invest in the success of the investment.

Encouragement of Homeownership

Islamic finance encourages homeownership by making it more accessible to Muslims. Families who once were unable to buy homes due to their religious beliefs can use Islamic financing to buy homes without violating the principles of their faith.

Types of Islamic Home Financing

There are several types of Islamic home financing contracts available, each with its own pros and cons. The three most common types of Islamic home finance arrangements are murabaha, ijara, and musharakah. The musharakah option, in which the financier and home buyer purchase the home as co-owners, is the preferred approach in the United States.

Murabaha

Murabaha is a type of arrangement in which the financier purchases the property and then sells it to the home buyer at a marked-up price. The financier receives payments from the home buyer until the property is paid off. This type of mortgage suits those who have a large amount of capital available upfront, as the initial cost of the property is higher than with other alternatives.

This option is beneficial as the home buyer knows the exact cost of the property upfront, and the financier is not at risk for any losses. However, the downside is that the property is technically owned by the financier until the home is paid off, which may not be suitable for everyone.

Ijara

Ijara is a type of Islamic financing arrangement in which the financier purchases the property and then leases it to the resident for a set period of time. The home buyer makes payments to the financier during this time, and at the end of the lease period, the buyer has the option to purchase the property at a previously agreed-upon price.

The benefit of ijara is that the home buyer has the option to purchase the property at the end of the lease period, and the financier is not at risk for any losses. However, one downside is that the home buyer does not own the property until the home is paid off, and the lease payments may be higher than with other types of financing.

Musharakah

Musharakah is an arrangement in which the financier and home buyer enter into a partnership to purchase the property together. The financier provides a portion of the capital needed to purchase the property, and the home buyer provides the rest.

In Guidance Residential’s Diminishing Musharakah model, the home buyer then makes payments to gradually buy the financier’s share of the property. The payments also include a usage fee so the homeowner retains full use of the entire property from the beginning. Once the full amount is paid off, the home buyer owns the property outright.

The musharakah arrangement is the preferred method of Islamic financing in the United States. The home is in the home buyer’s name from the beginning, and the buyer maintains full use of the home throughout the contract period. An added benefit to the home buyer is that the financier shares some of the risks of owning the home, unlike in a traditional mortgage. This type of contract offers home buyers all of the benefits of a conventional transaction, plus additional benefits as well, so it is the most popular form of Islamic home finance in the United States.

Related Read – What Is an Islamic Mortgage and How Does it Work?

How to Qualify for an Islamic Mortgage

To qualify for an Islamic mortgage, you must meet certain eligibility criteria. The exact requirements will vary depending on the financier and the type of financing you are applying for, but some common requirements include the following:

- Proof of income: You will need to provide proof of income, such as pay stubs or tax returns, to show that you can afford to make the monthly payments.

- Good credit: Like with any mortgage, having good credit is important. Financiers will look at your credit score and credit history to assess your risk as a business partner.

- Down payment: Most types of Islamic home financing require a down payment, which can range from 5% to 20% of the property’s value, or sometimes even less. The exact amount will depend on the financier and the type of financing you are applying for as well as any special programs that may be available, such as those for first-time home buyers.

- Debt-to-income ratio: Financiers will also look at your debt-to-income ratio, which is the percentage of your monthly income that goes towards paying off debt. A lower debt-to-income ratio indicates that you have more money available to make your monthly payments.

- Employment history: Financiers will want to see that you have a stable employment history and that you have been in your current job for a certain amount of time.

It’s important to work with an experienced Islamic mortgage provider who can guide you through the application process and help you understand the eligibility requirements for the specific type of financing you are applying for.

Related Reads:

- Islamic Mortgages for First Time Buyers, Part 2: Qualifications

- What Documentation Is Needed When Applying for Islamic Home Financing?

Finding an Islamic Mortgage Provider

If you’re interested in applying for an Islamic mortgage, it’s important to find a finance provider who specializes in Islamic finance. Not all financiers offer authentic Islamic home finance options, so you may need to do some research to find a reputable provider who can help you finance your home purchase.

Some tips for finding an Islamic mortgage provider include the following:

- Check for authenticity: Look for an Islamic home finance provider whose authenticity you can trust.

- Guidance Residential’s program was developed with the assistance of six of the world’s leading Islamic finance scholars and continues to be overseen by a Shariah board to ensure continued compliance with the principles of Islamic law.

- Avoid banks. While banks may claim to offer Islamic mortgages, their structure makes true Islamic financing impossible.

- Ask for referrals: If you know other Muslim homebuyers, ask them for referrals to financiers they have worked with in the past. (Still, do your due diligence though — check for yourself that the program is Shariah compliant.)

- Read reviews from other customers to get an idea of a financier’s reputation.

Related Watch: Guidance Is Not a Bank: Why an LLC Makes All the Difference

Common Misconceptions About Islamic Mortgages

There are a number of misconceptions surrounding Islamic home financing that can deter potential home buyers from considering this financing option.

Myth: It’s More Expensive

A common misconception is that Islamic home financing is more expensive than conventional mortgages. This may have been true in the past, but it is not necessarily true anymore. With Islamic home finance gaining in popularity, the costs have dropped to be comparable with conventional mortgages.

Related Read – Comparing Islamic Mortgage Rates with Conventional Financing

Myth: It’s Just a Mortgage Under a Different Name

Some people are under the misconception that Islamic finance is just a mortgage loan marketed differently. That couldn’t be further from the truth.

Islamic finance is based on a completely different foundation than a conventional mortgage’s lender-borrower relationship. In order to make the process comply with U.S. law as well as making it easier for consumers, the structure of the payments may look similar to a mortgage, but the foundation underneath is halal (acceptable under Islamic guidelines) while a mortgage loan is not.

One important note is the difference between interest and profit in Islamic finance. In conventional finance, interest is charged on the principal amount of a loan, which means the lender will continue to earn money regardless of anything that may happen to the home buyer or the property. In contrast, Islamic finance principles require that the risks of an investment be shared between the two parties. This means that the financier invests in the property – often as a co-owner – rather than charging interest on the loan.

Watch: Islamic Home Financing: Is It Really Different

Benefits of Islamic Home Financing

The first benefit of an Islamic mortgage is that by aligning with Muslims’ values and principles, it makes homeownership accessible to people who may otherwise not be able to purchase a home. However, the benefits extend further than that.

Risk Sharing

Islamic finance guidelines require risks to be shared by investment partners. Let’s look at an example of how that works in Islamic home finance.

Say a home buyer purchases a property and the home is destroyed in a natural disaster. In Islamic home financing, the financier would share the loss with the homeowner based on the percent of the property each party owns. In a conventional mortgage, the home buyer would be responsible for repaying the full amount of the mortgage and would assume the entire loss.

Sole Profit

While both parties share the risk, under the popular model pioneered by Guidance Residential, the home buyer is the sole party that benefits from any profit that arises from the sale of the home.

If the home’s value rises and homeowner sells the property, they do not share the profit with Guidance Residential. Instead, the homeowner retains all of the profit from the sale after repaying the amount they financed. It’s a win-win for the home buyer.

By choosing Islamic financing, homebuyers can enjoy a financing option that not only aligns with their ethical and religious principles, but it is also more equitable and favorable to the home buyer.

Related Read – 5 Misconceptions about Islamic Finance

Conclusion

In conclusion, an Islamic mortgage offers a responsible and ethical way for Muslim homebuyers to finance their homes. By adhering to Islamic finance principles, these arrangements operate on a model different from a lender-borrower arrangement, with the most popular approach being co-ownership.

Overall, the benefits of choosing an Islamic mortgage over a conventional mortgage include aligning with one’s ethical and religious principles, and comparable costs over the long-term.

If you’re a Muslim home buyer looking for an ethical and responsible way to finance your home, we encourage you to consider an Islamic mortgage. Contact Guidance Residential to learn more about Islamic home financing and how it can benefit you.

If you’re ready to take the next step, get pre-qualified online in fewer than 10 minutes with Guidance Residential today.