Understanding Halal Mortgages in the U.S. “A Comprehensive Guide for Homebuyers”

Are you a Muslim homebuyer in the U.S. searching for a Islamic mortgage option vs. conventional mortgage?

Finding the perfect mortgage can be a complex and time-consuming process, especially for home buyers adhering to Islamic values. Fortunately, Islamic or halal mortgages are gaining popularity in the USA, offering Muslim home buyers an ethical and convenient choice.

In this comprehensive guide, we will explore Islamic mortgages in the USA — their definition, functionality, and why they are a viable solution. Our goal is to make it easy for you to understand the essence of Islamic home financing and why it is preferable to conventional mortgages.

What is a Halal Mortgage?

Islamic mortgages are a type of home financing that do not involve any riba or interest payments.

Types of Halal Mortgages: Highlighting the Most Preferred

Halal mortgages come in several types. Three types of Islamic home financing models are fairly well-known in the United States: Ijara, Musharaka, and Murabaha. These models, known as nominal contracts, all comply with Islamic guidelines, and each model has its own rationale. Among these types, Musharaka is generally considered the most preferred method for buying a home in the U.S.

It is important to be aware of the distinctions and choose the appropriate model that aligns with both Islamic financial principles and the regulatory framework in order to ensure compliance and effectiveness in financial transactions.

Murabaha

In a Murabaha contract, the bank buys the property and sells it to the buyer at a marked-up price, to be paid in installments over a specific period. The markup is a profit margin agreed upon by both parties at the outset of the transaction.

Murabaha is considered less favored because it creates an obligation for the home buyer that can resemble debt.

Ijara or lease-to-own financing

Another model is ijara. Ijara is a widely accepted tool that is commonly used in financial transactions worldwide. However, in the United States, it may not be the optimal type of contract.

In this model, the financier purchases the property and then leases it to the buyer for a specific period. The buyer makes monthly payments that include both a portion of the property price and a rent payment. At the end of the lease period, the buyer owns the property outright.

In Ijara, the home buyer is basically a tenant for the entire period of the contract and does not enjoy the benefits of homeownership until repayment is complete. This can be a drawback for some Muslim homebuyers in the U.S.

Musharaka: The Preferred Choice

The Musharaka model involves co-ownership between the home buyer and the financing company. Both parties invest in a property and purchase the home together.

In a variation called Diminishing Musharakah, or the Declining Balance Method, the home buyer gradually acquires the financier’s stake in the property while paying a fee to utilize the portion still owned by the financier. Diminishing Musharakah is considered the most favorable option.

In this case, initially, each party owns a share of the home proportional to the amount they contributed. Over time, the buyer’s ownership stake increases while the company’s share decreases until the buyer owns the entire property.

The buyer maintains full ownership rights for the property from the start, like any other homeowner. The rights and responsibilities of each party are clearly defined in the contract, with special protections provided to the buyer that do not exist in a traditional mortgage.

The Musharaka method aligns perfectly with the principles of Islamic law as well as the goals of homeowners in the U.S., making it the most attractive option.

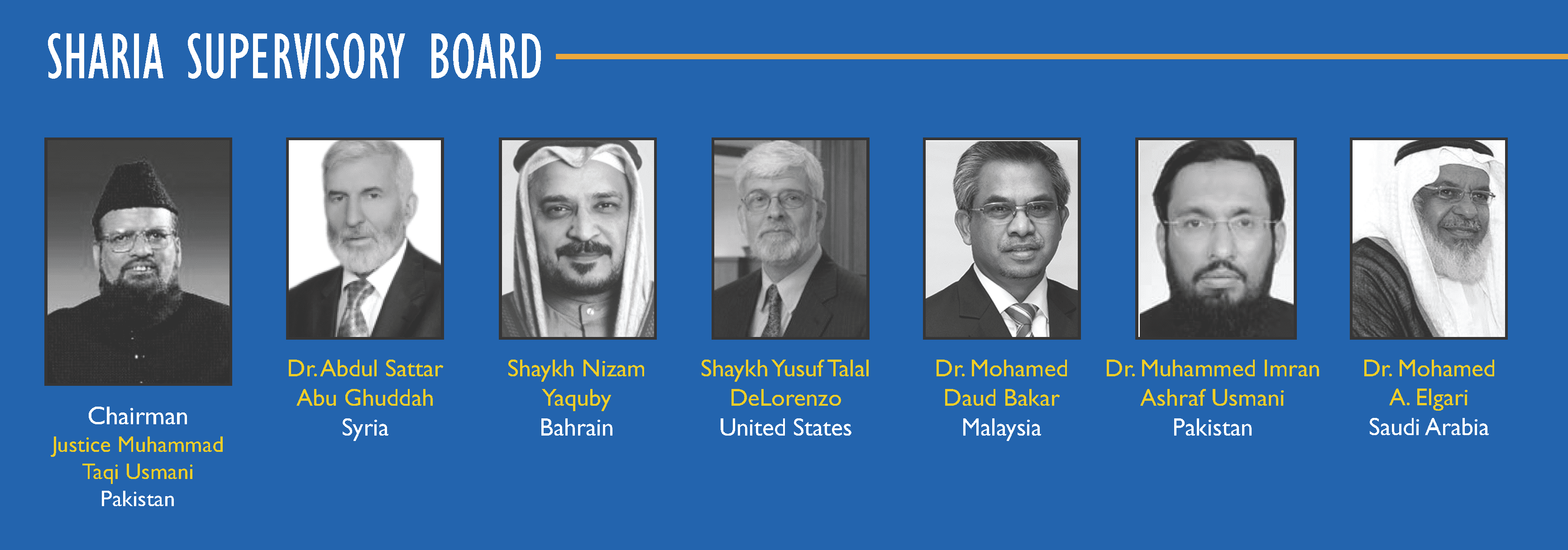

The Importance of an Independent Shariah Board: Ensuring Authenticity

An Islamic mortgage provider should be overseen by an independent board ensuring its sharia-compliant status.

Sharia law encompasses a vast subject matter, and the branch that deals with contracts and business is highly specialized. A shariah board is essentially the guarantee for the customer that the products or services offered by the provider will yield halal results.

The AAOIFI, the auditing and accounting organization for Islamic financial institutions, has established in one of its standards for the industry that any financial organization claiming to be Islamic must maintain a shariah board of at least three scholars to guarantee its Islamic authenticity.

Islamic banks vs. non-bank Islamic financing

While banks have begun to claim that they offer an Islamic mortgage, true sharia-compliant mortgages cannot be provided by a bank in the U.S.

Like other Abrahamic faiths, Islamic law strictly prohibits riba, which is lending and borrowing money at interest. Interest is what U.S. banks are based upon.

Banks convert cash deposits into debt, selling more debt through credit cards or interest-bearing loans. Financing a home through a bank means enriching the bank and indirectly supporting ventures prohibited by Islam.

Some mainstream banks even claim to have adopted similar models to Guidance’s co-ownership program. However, U.S. banking laws prohibit banks from investing in and owning real property, making true co-ownership impossible.

Fortunately, Islamic home financing providers are now available to provide an authentic Islamic mortgage for U.S. home buyers.

The most popular option for a halal mortgage is Guidance Residential, the company is not a bank and does not charge interest. It is the only Islamic home financing provider that establishes co-ownership with consumers via an LLC. The Assembly of Muslim Jurists of America (AMJA) has endorsed Guidance and its co-ownership model as a permissible path to Islamic home financing.

Benefits of a Halal Mortgage

Islamic mortgages offer numerous benefits that set them apart from conventional interest-based mortgages. They provide a way to purchase a home while adhering to religious principles and ensuring ethical and socially responsible financing. Let’s explore the unique factors that differentiate Guidance Residential’s program:

Co-ownership: Both the customer and the company buy the home as partners, which is a more equitable arrangement than a debtor-creditor relationship with a conventional mortgage broker.

Riba-free: The Declining Balance Co-ownership Program offered by Guidance Residential is 100% riba-free. It doesn’t involve any interest, aligning with Islamic financial guidelines.

Risk sharing: Guidance Residential shares the risk with the home buyer in certain instances like natural disasters or eminent domain. This is a benefit banks do not offer.

No prepayment penalty: Flexibility is a key feature of this program. Homeowners are not charged any fees if they decide to pay off the home earlier than anticipated, offering them financial autonomy.

Capped late payment fees: Late payments should not be an opportunity for the financier to earn additional profit. To ensure fairness, late payment fees are capped at $50 to cover the expenses of administering a late payment.

Default and foreclosure: Unlike traditional lenders, Guidance Residential does not pursue customers’ personal assets in case of foreclosure.

Read 10 common questions and answers about Islamic mortgages.

How to Qualify for a Halal Mortgage

When it comes to buying a home with Islamic financing, while the contract is halal, the process follows the same steps as any other U.S. home purchase: application, processing and underwriting, and closing. In this section, we will guide you through each step of the process.

Step 1: Qualification or Application

To begin, whether you are buying or refinancing a home, you will provide essential information about your finances. This step allows you to determine how much funding you may qualify for. This helps you narrow down your search for your dream home.

Guidance Residential offers two options to start your journey: a quick Pre-Qualification for a rough estimate, or a Pre-Approval Application for a more detailed assessment. Pre-Approval signals your preparedness to home sellers and real estate agents.

In the Pre-Approval application, you will submit documentation related to your income, employment, and savings. Guidance’s user-friendly online application simplifies the process and expedites your Pre-Approval, helping you complete it conveniently at your own pace.

Recap—what to do in this phase:

• Complete the Pre-Approval application

• Provide necessary documentation for Pre-Approval

• Discover more: Pre-Approval vs. Pre-Qualified: What’s My Next Step?

Step 2: Processing and underwriting

After you submit your documentation, an underwriter will review your application. They may ask for additional documents, so it’s important to watch for communication from them and respond in a timely manner. You will receive a response providing valuable insight into the financing options available to you.

Pre-Approval makes the financing process go more quickly and smoothly once you find the home you want to buy. Once you find a home and your offer is accepted by the seller, you will move forward with the financing process specifically tailored to that property.

Since you will have already obtained Pre-Approval, much of the groundwork will have already been completed and now you will only need to provide the final documentation. The online portal allows you to upload documents through your phone and easily track the status of your application.

Recap—what to do in this phase:

• Review documents submitted for underwriting and answer any questions posed by the financer.

• Ensure all requested documents are provided in a timely manner.

• Keep all lines of communication open during the process.

Step 3: Closing

Once your file is approved by the financer and all preparations are complete, you will proceed to the closing stage. During this process, a title company or closing agent will be responsible for handling all paperwork and transferring money for the sale of the home. You’ll sign the papers at closing, and the financier will disburse funds directly to the seller.

Recap—what to do in this phase:

• Work with the title/closing company to complete all paperwork.

• Confirm your agreement to purchase the home and sign closing documents.

• Remember to bring a valid form of identification (driver’s license, etc).

With these three steps, you are now equipped to handle an Islamic home buying process.

Read more about what is an Islamic mortgage and how it works.

Halal Mortgages in the USA

Halal mortgages are becoming increasingly popular, especially with Muslims who wish to buy a home while adhering to their religious beliefs. With no interest payments involved, an Islamic mortgage offers a more ethical and socially responsible way of home financing.

To qualify for a halal mortgage, the process follows the same steps as any other U.S. home purchase: application, processing and underwriting, and closing.

As a non-bank, riba-free Islamic mortgage provider approved by an independent shariah board, Guidance Residential shares in the ideals of the American dream of home ownership. Since 2002, Guidance has helped over 30,000 Muslims achieve home ownership in line with their values. With a little help from Guidance Residential, your dream of owning a home can become a reality.