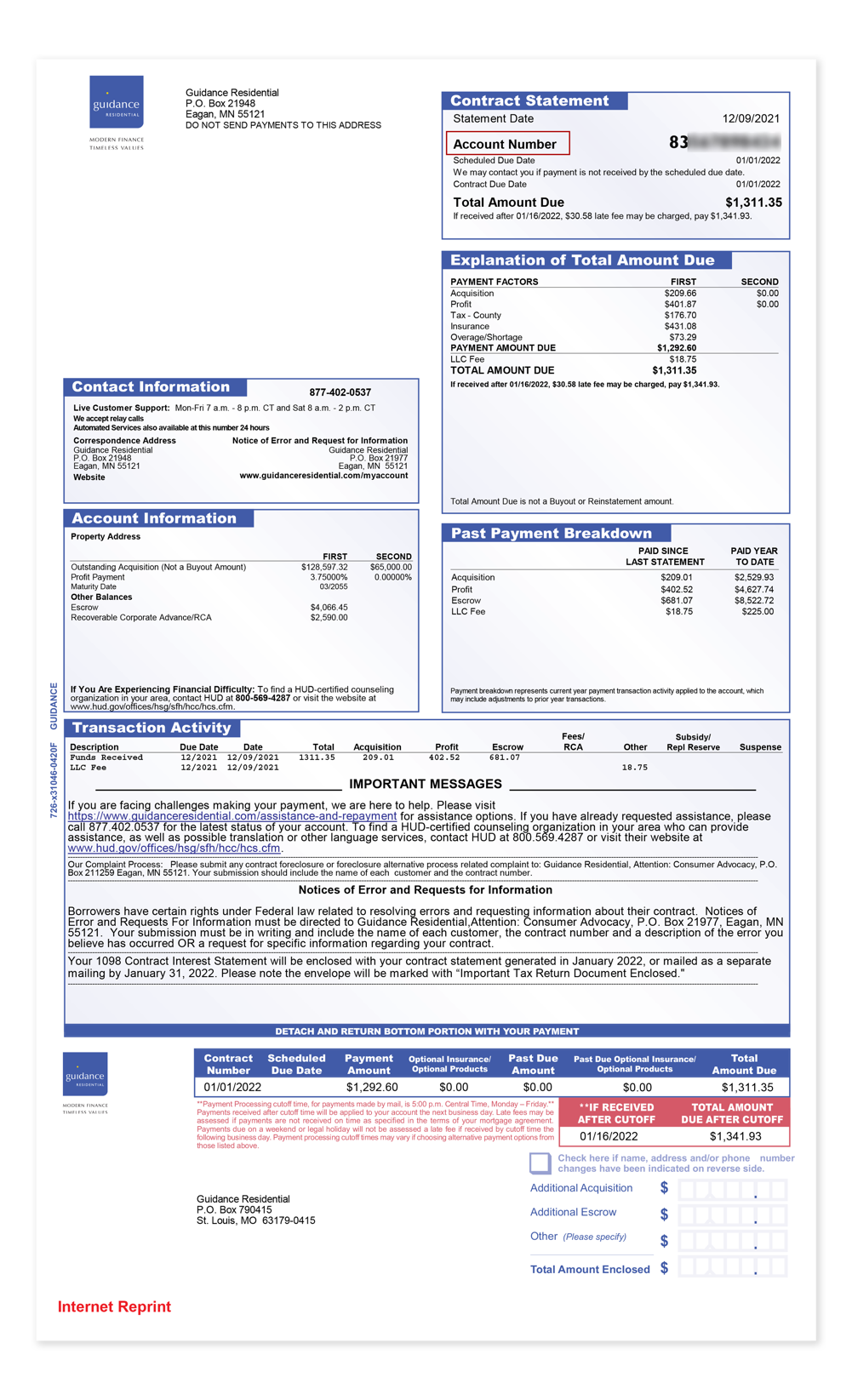

You will receive a billing statement each month that reflects your monthly contract payment. Please pay the amount indicated on the statement and include your account number that is listed in the top right corner of the statement on your check. You may pay additional funds to apply towards the acquisition balance or future payments. If you would like to do so, you must either notate the additional funds and the purpose on your coupon or contact a customer service representative at 1-877-402-0537, prior to including additional funds through an ACH or other payment.

We do not accept payments in this manner. If you are unable to make your entire contract payment because of financial hardship, please contact our Default Counseling Department at 1-877-402-2043 between Monday - Friday from 7:00 AM - 8:00 PM CT and Saturday from 8:00 AM - 2:00 PM CT (or we accept relay calls during these same times) to make payment arrangements.

The Pay Online option is only available for customers who are current on their payments and may not be available for customers whose account is either past due or has some other type of hold. Certain restrictions and limitations may apply. There is no fee for this service if paid on or before the due date.

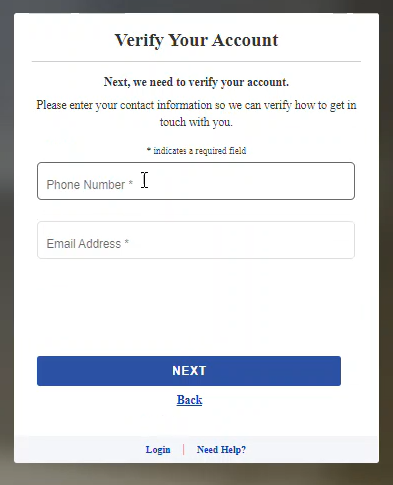

Customers who have accounts that are current are able to make payments using the online payment system. To make a payment online, follow these instructions.

- Log into Guidance Residential's "Customer Account Management Website:" www.guidanceresidential.com/customeraccount

- From the Account Dashboard, click on the Payment box at the top of the page to navigate to the Payment tile or click directly on the "Make A Payment" hyperlink on the Payment box to receive the Payment pop-up screen.

- Once on the Make a Payment tile or pop up, select the type of payment to make (monthly payment amount or other), select a payment method (source of funds), and payment date.

- Confirm the Total Payment amount looks correct, then click the "Submit Payment" button.

- A pop-up confirming the payment will display so you can confirm or cancel the payment.

- If you confirm the payment, a Payment Confirmation message will appear.

- Once you exit the confirmation message, you will see your scheduled payment in the "Scheduled Payments" tile.

Payments made online prior to 6:30 PM CT, Monday through Friday, will be processed and applied the same day. Payments made online after 6:30 PM CT, Monday through Friday, or on holidays, or weekends, will be processed on the next business day and the E-Check payment date will reflect the applicable payment date

Please send your mail-in payments to the following address and write your account number on the check.

Mailing Address:

Guidance Residential

P.O. Box #790415

St. Louis MO 63179-0415

ACH payments provides Guidance Residential monthly authorization to electronically debit either your checking or savings account for the total monthly payment amount due on your account. Additional acquisition payments may also be set up for ACH drafts.

You can set up an ACH draft automatically on www.guidanceresidential.com/customeraccount. New contracts may require up to 30 days for audit before the auto-draft option is available. Customers must have accounts that are current, and must be registered on www.guidanceresidential.com/customeraccount for at least 24 hours before we can accept an online ACH activation.

To set up an ACH draft, follow these steps:

- Use your login credentials to log on to www.guidanceresidential.com/customeraccount.

- Select the "Payment" chicklet ("payment" box) and on the Payment subtile click on "Enroll in Autopay". Note: A payment method needs to be added to the account before Autopay can be enrolled.

- Select either your due date or up to 9 days after your due date (per the guidelines of the grace days allotted on your contract) for the ACH draft to occur.

- Check the box to agree to the terms and conditions, then click "Enroll". If the draft date falls on a weekend or holiday, your account will be debited on the next business day. A monthly billing statement will continue to be received for informational purposes only.

A letter will be sent to you to confirm the accuracy of the information you have entered. You may also change or delete your draft information with our online system, at least 15 days prior to your draft date to allow enough time for completion.

Please continue to send your monthly payment with the billing statement until the first draft date. If your account is past due, a draft will not occur until the account is current. If your account is prepaid, a draft will occur. You may pay additional funds to apply towards the acquisition balance or future payments. If you would like to do so, please contact a customer service representative at 1-877-402-0537, prior to including additional funds through an ACH payment.

You can find your payment information such as status, payment history, and more by clicking on the "Payment" chicklet ("payment" box) from the Dashboard after you login.

If any monthly payment due is not received by the end of fifteen (15) days after the date it is due, a late fee payment will be charged. Please refer to the Obligation to Pay Agreement you received and signed at the closing of your transaction to determine how many days you have between your due date and the fifteen (15) day grace period. Payments due on the 1st day of the month are considered late if not received on or before the sixteenth (16) day of the month.

The Pay by Phone payment method allows customers to pay their current contract payment by telephone either through our automated voice system or by speaking with a customer service representative. To access the Pay by Phone payment method, contact our Customer Service Call Center at 1-877-402-0537. You will need the routing number and account number of your checking or savings account to process the payment request. Upon completion, the contract payment will be electronically drafted based on the account information entered.

You are responsible to make your payments regardless of the receipt of a billing statement. We send billing statements to all customers as a reminder that payment is due. However, you are responsible for making timely payments, even in the rare instance that the mailed statement is not received. We offer several methods for you to check the payment amount due as well as make payments without a statement, such as online, the Speed Pay telephone method, ACH draft, Western Union Quick Collect, and in-person at a local US Bank branch.

Please send your mail-in payments to the following address and write your account number on the check.

Mailing Address:

Guidance Residential

P.O. Box #790415

St. Louis MO 63179-0415

Your payment due date was established when you originated your contract and is stated in the Obligation to Pay. Most Obligations to Pay state that the payment is due by the first day of the month. However, some customers have due dates other than the first of the month, so it is a good idea to take a look at your Obligation to Pay to see which day your payment is due. You can also find this information by checking your monthly statement, access online, or call the Customer Service Department at 1-877-402-0537 between Monday - Friday from 7:00 AM - 8:00 PM CT and Saturday from 8:00 AM - 2:00 PM CT.