Why Millennials Should Buy a Home

A common misconception is that millennials aren’t buying homes. But the stats report otherwise. According to the Association of REALTORS® 2021 Home Buyers and Sellers Generational Trends Report, millennial buyers are the largest share of homebuyers at 37%. And the stats also show that this group continues to grow. If you’re a millennial considering homeownership, here’s why now might be the time.

5 Reasons Why Millennials Should Buy a Home

The homebuying journey isn’t easy but millennials may want to consider doing it now rather than later. It is a huge investment—most likely the largest one you’ll make. There are benefits that come along with your decision to own a home and if you’re currently deciding, here are some reasons to buy a home.

1. Life Goals

It’s true that many millennials (young adults born between 1981 and 1996) are marrying, buying homes, and starting families later in life. However, for older millennials, that “later in life” window is now. But think about your goals for the next few years and consider those points before jumping into purchasing, not just because everyone else is.

2. Rising Rents

Monthly rent spiked by a record-setting 18 percent in 2021, according to a report by Apartment List, and few landlords voluntarily decreased their rent. Renters who do experience lower rents usually initiate negotiations. But even with negotiating a lower monthly cost, your payments are ultimately going to your landlord and not towards your own home. And with rising costs, many are considering homeownership because of the stability that owning your own home can provide.

3. Health & Safety

The National Association of Realtors (NAR) reports that homeowners are happier and healthier than non-owners. While this isn’t a direct correlation, they have drawn conclusions that homeownership is correlated with income and education levels, which are typically associated with better health. Additionally, homeownership means a buyer has a larger financial stake in their home than a renter does.

This usually results in more active involvement in home maintenance, community building, and social activities. A deeper level of involvement leads neighbors to have deeper social ties with each other. And this sense of community turns neighborhoods into better places to reside.

4. Rising Home Values

The good news for current homeowners is that home values continue to rise. Zillow predicts home values will rise by 11% in 2022. So, if homeownership matches with your life goals and financial situation, it may be worth considering purchasing a home now rather than later.

5. Potential for Rental Income

If you’ve been thinking about investing in real estate, purchasing a multi-family home, living in one of the units, and renting out the other units might be the route for you. It allows you to benefit from both homeownership and being a landlord. And this way, you have the opportunity to own your own home, start investing, generate income, and become an on-site property manager.

Where Are Millennials Buying Homes?

In an analysis conducted by data firm Corelogic, when millennials consider where to purchase a home, they factor in “home affordability, employment opportunities, flexibility to work remotely, local tax rates and preference for open spaces.”

These Are the Markets Where It’s Cheaper to Buy vs. Rent

There are ten markets, according to The Washington Post, where renting may be a better choice than buying due to an increase in rents. These markets include Birmingham (Alabama), St. Louis, Pittsburg, Orlando, Cleveland, Tampa, Baltimore, Indianapolis, Virginia Beach, and Riverside (California).

These Are the Markets Where It’s Cheaper to Rent vs. Buy

Meanwhile, The Washington Post also reported the markets where renting is favored over buying due to the expensive housing market. Those cities include Austin, San Jose, San Francisco, Seattle, Boston, Los Angeles, New York, Dallas, Rochester (New York), and Portland (Oregon).

6 Ways Millennials Are Making Homeownership Happen

Millennials are typically at a point in their lives when their careers are growing and they’re paying off as much student loans and debt as possible. Especially during the pandemic, Americans have paused costs, resulting in 45% reporting that they were able to build up a nest egg according to a New York Life survey.

These extra savings and more are how millennials are making homeownership possible.

1. They’re making more money.

A Pew Research study found that household income rates of this bunch were two to four times higher than that of other age groups. This financial standing allows millennials the ability to buy a home for the first time.

2. They’re getting help from their families.

Many have chosen to move back in with their parents and have tended to stay longer than ever before. According to this Pew Research study, 52% of adults aged 18-34 live with their parents due to economic factors and the Covid-19 pandemic.

3. They’re growing their savings.

According to a New York Life survey, many Americans have experienced paused costs during the pandemic. This allows for an increase in savings, which can go towards an initial payment towards a home.

4. They’re buying homes in more affordable locations.

Millennials are moving out of the city in larger numbers. A recent Zillow study shows that 47% of millennial homeowners live in the suburbs, as opposed to urban and rural areas.

5. They’re opting for houses with smaller footprints.

As millennials have started to buy homes, a pattern has emerged: They aren’t interested in their parents’ big homes. According to a Clever survey, millennial homebuyers say 1,700 square feet is enough space. For reference, boomers—who might even be downsizing—say they’re looking for a place that’s around 1,900 square feet.

6. They’re working with non-banks.

The things this generation loves about the internet are also true of the online mortgage industry. They love simple user experiences, quick digital communication, and on-demand service for when they’re ready to buy. It’s no wonder why six out of the top 10 lenders were non-banks.

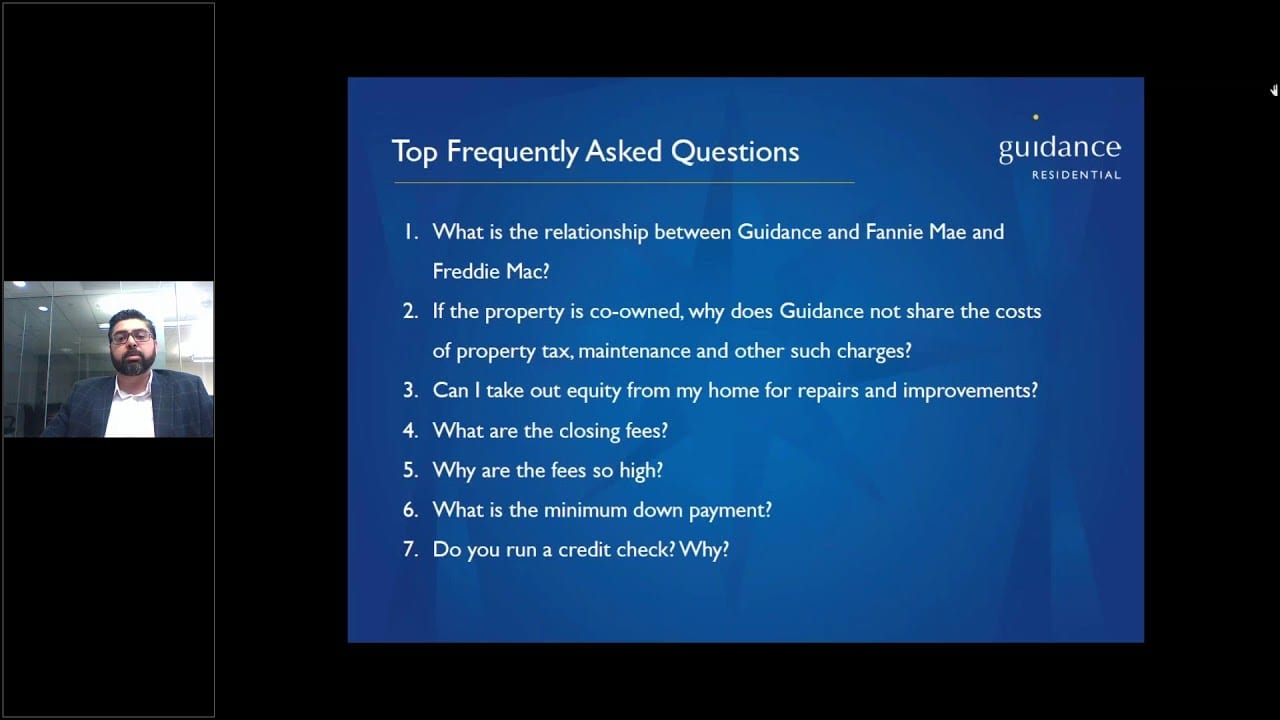

When choosing Guidance Residential for home financing, you are partnering with us and not a bank. We aren’t even a subsidiary of a bank. We also ensure you are not taking part in riba, or interest, which is prohibited in Islamic law and Abrahamic faiths.

>> Learn more about Islamic finance

To purchase a home, we establish a co-ownership commitment agreement with you via a limited liability company, or LLC which offers consumer protections unlike any other path developed. In this diminishing partnership, the homeowner agrees to pay a usage fee for the portion of the property they don’t yet own, which lessens as their stake in the property grows.

Getting Started with Buying A Home

Homeownership is possible without engaging in riba or with a bank. But before you start looking at houses, pre-qualify for home financing online now in fewer than 10 minutes. Your pre-qualification results will help you know how to strengthen your credit, gather your financial documents, and provide an initial monthly payment estimate for homes in your budget.

Originally published February 2016, updated September 2022.